Anything Loan providers Are able to use to evaluate Your loan Software

Search certain loan providers, including antique banking institutions, borrowing from the bank unions, on the internet lenders, and you can certified lenders having unemployed individualspare interest rates, loan payment terms, and you may qualifications requirements to understand the most suitable alternatives.

Knowing your credit score beforehand can help you stop applying for loans you might not qualify for. This is because you could potentially know if your credit score is also lowest. You might stop throwing away persistence to the apps that may likely be refused.

Get Financing

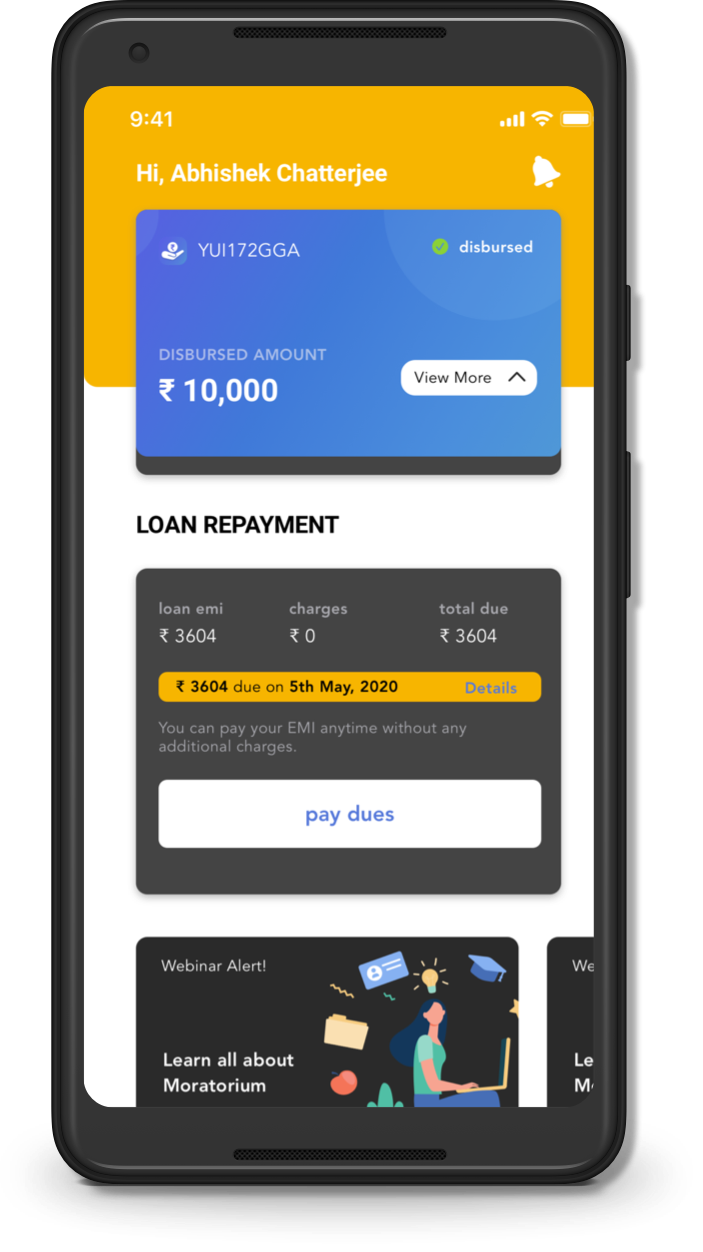

Once you have chosen a lender, initiate the application form process. Be ready to promote private information, economic documents, and you can facts about their unemployment state. Particular lenders need equity otherwise an excellent cosigner, so be ready to fulfill its particular criteria. Abreast of approval, disbursing your loan financing may require times otherwise several business days, according to lender’s processing date.

Think of, its important to be transparent concerning your unemployment position plus policy for financing fees. With a well-thought-aside fees method can raise your odds of acceptance. See fund one fulfill debt requires and have now in balance terms and conditions to end too many financial obligation while you are jobless.

After you inquire https://speedycashloan.net/payday-loans-la/ about financing, loan providers check your creditworthiness to choose when they is always to agree your own consult. Loan providers thought evaluating your financial balance and you can capability to pay new financing, which are crucial items. Lenders view your loan application according to about three important aspects: earnings, debt-to-earnings proportion, and credit score.

Earnings

Your earnings the most important issues lenders thought when looking at an application. It clearly suggests debt power to repay the loan. Loan providers you want proof regular income, such as for instance out-of a position, self-a career, rental income, using, or pensions.

To assess your earnings, lenders get demand data files instance spend stubs, taxation statements, bank statements, or income verification characters. It study these types of records to confirm their income’s matter, surface, and you will accuracy. A constant and sufficient earnings reassures lenders that one may fulfill the month-to-month loan debt.

Understand that different kinds of finance may have particular money standards. By way of example, a home loan company may work with your capability to manage enough time-identity mortgage repayments. Having said that, a consumer loan lender could possibly get highlight your brief-identity repayment effectiveness.

Debt-to-Income Ratio

Lenders make use of the loans-to-earnings proportion to check on as much as possible handle a whole lot more obligations and you may evaluate your financial better-are. So it ratio compares your own monthly debt obligations towards month-to-month income and you can conveys it a portion.

Locate your own DTI, create your month-to-month debt payments, such finance, credit card minimums, and other bills. Then, divide which complete by the month-to-month earnings and you can proliferate of the 100 to get your DTI payment.

Loan providers has actually varying DTI thresholds, but a lesser DTI is generally more positive. A reduced DTI function your earnings is enough to safety your bills being handle new mortgage costs with ease. With a leading DTI makes obtaining a loan more complicated or choosing quicker positive terms and conditions. For the reason that this means that you may have complications meeting additional bills.

Credit rating

Your credit score is a vital element of your loan software evaluation. Lenders see your credit score from or higher big credit bureaus (Equifax, Experian, TransUnion) to test the creditworthiness. Your credit history includes reveal borrowing and you can repayment records, also charge card account, money, and commission patterns.

Lenders generally speaking feedback your credit score to evaluate your credit rating, which is a numerical logo of your creditworthiness. A top credit score reduces chance and renders providing recognized getting that loan that have good terms easier. In contrast, a diminished credit score can lead to mortgage denials or higher rates of interest.