Try Thriving Partners Entitled to a good Virtual assistant Mortgage?

09 Late Was Thriving Partners Eligible for an effective Va Home loan?

Groups of energetic duty solution users and you will veterans meet the requirements to apply for Va experts. Survivors can also be eligible for extra gurus. In case the partner try Destroyed for action (MIA), good POW (Prisoner-of-war), passed away on collection of obligation otherwise suffered with a service-relevant disability, you are eligible for more professionals readily available under the Virtual assistant loan system.

The answer is actually sure! Along with eligibility on the system, youre as well as qualified to receive additional advantages such no resource costs plus down rates.

Exactly what are the Surviving Partner Va Mortgage Standards?

To help you qualify for an excellent Virtual assistant financing, you must are single after the death of your wife. As well, no less than one of one’s pursuing the requirements must be came across:

- Your wife passed away throughout the line of solution or regarding a good service-relevant impairment/injury/position

- Your wife was MIA otherwise an excellent POW for around ninety weeks

- Your lady had a support-relevant impairment and you can are qualified to receive impairment compensation at the time regarding death.

In the event the significantly more than requirements try satisfied, and you are clearly entitled to the loan, try to finish the adopting the:

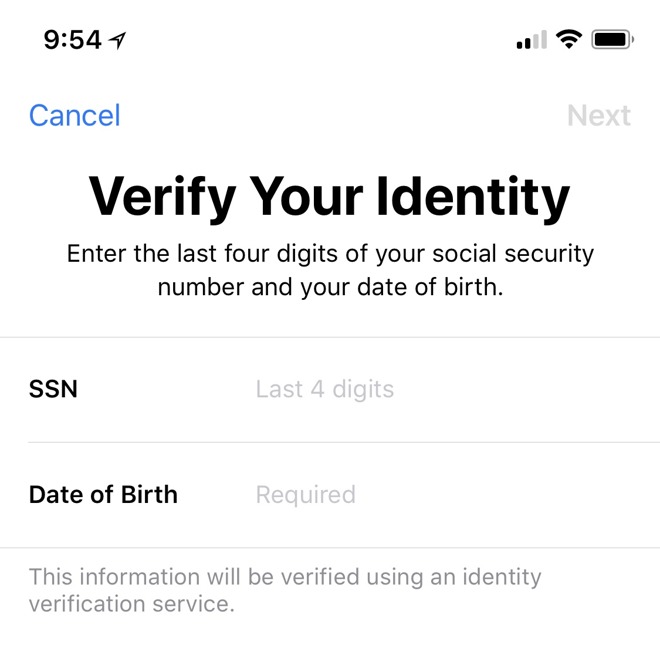

- Get the newest Virtual assistant Certificate of Qualification (COE). You might incorporate on the internet, through the post, or via your Virtual assistant-recognized private bank.

- Match the lender’s conditions, plus at least credit history from 620, a financial obligation-to-income ratio away from below forty%, and you can a good credit score.

- Violation the newest MPRs outlined by the Va.

Which are the Great things about a surviving Spouse Virtual assistant Mortgage?

- See a loan versus and come up with a deposit or to buy Personal Home loan Insurance (PMI)

- Be eligible for down interest levels

- No prepayment punishment

Why does brand new Va Define Spouse?

Depending on the Virtual assistant, a wife try anybody married so you can a veteran otherwise provider representative, so long as their matrimony is acknowledged by legislation where they live otherwise after they sign up for Va masters. The fresh new department today understands same-sex marriage ceremonies.

Variety of Virtual assistant Lenders a surviving Spouse Can apply Having?

Thriving partners are eligible for everybody sort of Virtual assistant financing, actually refinancing loans, offered you citation new eligibility criteria. Is an overview of some loan designs you could potentially qualify for once the an enduring partner:

Va pick fund is actually financial alternatives that may help you buy the place to find their desires without worrying on the a massive down commission. Everything you need to manage is meet the qualification standards, reach the COE, satisfy the lender’s conditions and ensure the domestic matches all of the the fresh new MPRs.

Va IRRRL (Streamline Refinance mortgage)

Interest rate Prevention Refinance loan (IRRRL) is actually a beneficial refinancing option that will help you refinance a current Virtual assistant get loan from the a lower interest rate.

Virtual assistant Bucks-Aside Home mortgage refinance loan

A good Va Bucks-Away Refinance loan enables you to re-finance an existing loan from the leveraging the residence’s collateral. This should help you consolidate costs, pay charge, and you may pay-off unforeseen expenditures.

How to Submit an application for good Va Financing while the an enduring Partner?

As the an enduring lover, the application processes varies depending on the receipt regarding Virtual assistant Dependence and Indemnity Settlement (DIC). Experts providing regarding military, providing just like the POWs, otherwise perishing on account of a help-relevant injury or condition is generally entitled to the DIC, that’s an income tax-100 % free economic work for.

1: Score good COE

For many who located DIC, you will need to submit the brand new Virtual assistant Means 26-1817 and also the Veteran’s DD214 into financial or regional Va office.

If you aren’t researching DIC, you’ll want to use of the filling in the applying to have DIC: Survivors Your retirement and you may Accumulated Masters (Virtual assistant Mode 21P-534EZ). You will you need their veteran’s discharge records (DD214), a copy of wedding permit, and the veteran’s passing certificate. Immediately following applying, make an effort to fill in Virtual assistant Setting 26-1817 with the service.

Step two: Make an application for the latest Virtual assistant Financing

The next step is to discover the COE shortly after specific you meet the criteria. Often the lender can obtain the mortgage, you can also incorporate separately through the send or within a local work environment.

If you are using from lender is fairly smoother, i suggest you apply on their own. This will allow you to compare quotes and pick an informed price.

Step 3: Family Browse

Pro-Idea: Before applying for the loan, it is recommended you get a pre-approval. With a pre-approval, you can determine how much you qualify for. This will allow you to choose a house under your budget.

Step 4: Get Va Assessment into Household

Once selecting the property, your lender tend to get the newest Va financing assessment. An appraiser from the Va commonly visit the property and you will evaluate they to three or higher comparable properties to decide their genuine really worth. The fresh appraiser will also ensure that the domestic meets the MPRs.

If the appraised well worth suits the price of our home, you are prepared to have financing closure. Although not, if your appraised number was less than the expense of the newest property, here’s what can be done:

Step 5: The financial institution Have a tendency installment loan South Dakota to Feedback the applying

Pursuing the bank critiques the application, you might proceed to the very last a portion of the loan application- Financing Closing. Be sure to be ready with the records to eliminate way too many complications.

What you should Recall

It’s adviseable to just remember that , you will have to meet the lender’s specific standards in addition to the VA’s standards having mortgage approval. Given that an enduring companion, for many who remarry, you simply be eligible for the borrowed funds for individuals who remarried on the/following the ages of 57 as well as on/immediately following .

Was an enduring Spouse Virtual assistant Home loan Best for you?

Being qualified getting a Va mortgage can help you get your dream household, even as a surviving companion. The countless professionals connected to they ensure it is an enticing solution for people who meet the requirements. Contact your lender observe what you need to do in order to implement and you may qualify. It can be the best choice for your and your friends.