Improve your Credit history from the 100 products inside the forty-five months

Increasing your credit history is actually a well-known matter one scores of some one offer their suggestions about. Meeting Home loan has been speaing frankly about credit scores for the last 25 years, therefore take it away from united states: not every one of one data is real.

Based on Experian, the common American’s credit history inside the 2017 was 675. You to definitely amount belongs to what most loan providers would think an effective fair otherwise good rating, for example financing businesses essentially believe that these individuals is actually in control and you may dependable adequate to approve for a financial loan.

Do not worry in the event the credit rating is part of the common. With a bit of devotion and several of use training, we’ll make it easier to make a plan on right guidelines that may increase your credit score from the 100 circumstances (undoubtedly!) within just 30 days and a half. Ready to begin?

What is actually a good credit score? Credit ratings include 3 hundred-850, which have 850 being thought outstanding. The typical credit rating in the united states try 695, a most-go out higher. 650 is known as an excellent fair credit history, however, we advice aiming for a rating of at least 700.

How can i increase my credit history?

Now that you’ve all the info towards why should you improve your credit rating, listed here are four easy ways that could possibly get improve credit rating because of the 100 affairs during the 45 weeks:

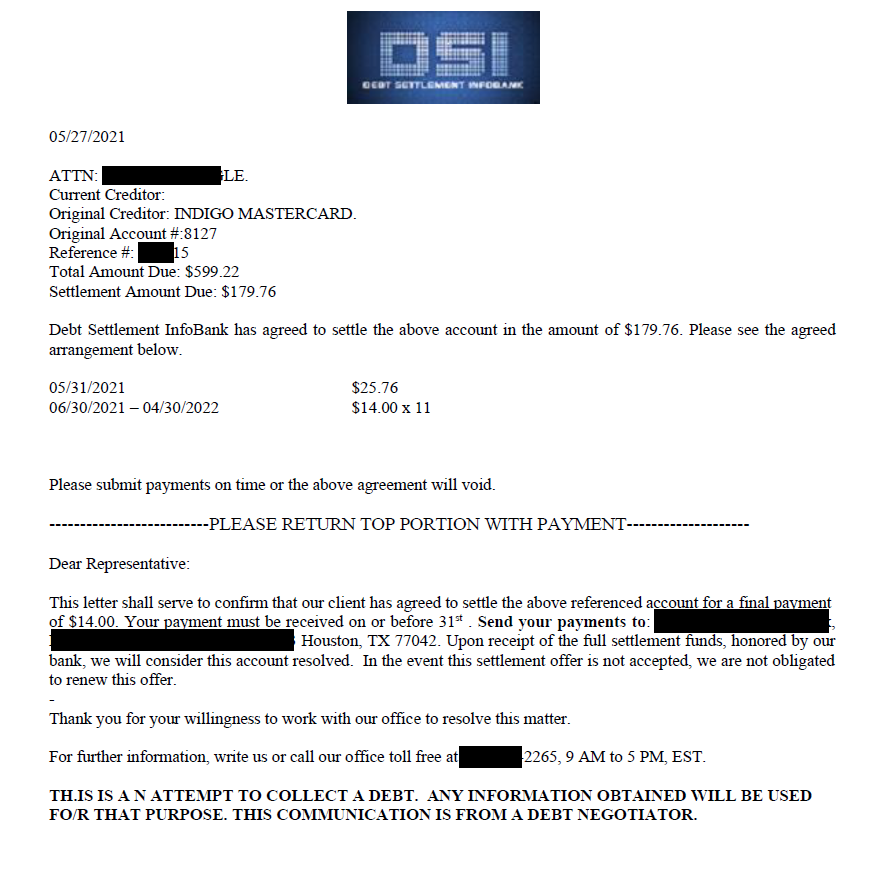

Pay your overdue levels

Your credit score will never make the most of which have early in the day expenses. When you yourself have one account which have past-due repayments, be sure to focus on purchasing these types of back again to brand new collector.

Decrease your late costs

* If this sounds like possible, you can generate what is referred to as a goodwill letter to spell it out to your collector why your percentage try late. You may be in a position to manage the challenge, particularly if this is your basic overlooked commission. But not, there’s no ensure that your own creditor usually improve your account.

Getting friendly and sincere is essential inside circumstance, and this will very likely enhance your odds of getting the later money removed. In the event the to start with brand new creditor refuses, you should never surrender. You can label once again later on and try the fortune with a unique user.

Decrease your borrowing from the bank usage

Borrowing from the bank usage ‘s the proportion of your balance you really have into the the credit card than the your own borrowing limit. It factor plus performs a switch role on your credit rating. Balance over 70% of one’s complete credit limit on the one cards wreck the rating the absolute most. All round guideline should be to shoot for a card use of 29% otherwise faster.

Prevent closing the credit cards

Your debt-to-borrowing proportion is a primary reason behind deciding your credit rating. That have a premier number of debt versus the overall readily available borrowing from the bank will decrease your credit rating. For many who personal a charge card as you continue to have personal debt, you immediately improve your loans-to-borrowing fee.

Instance, if you have $1000 in financial trouble and $255 payday loans online same day California you can an excellent $ten,000 borrowing limit, the debt-to-credit ratio is just 10%. not, for many who cancel credit cards that offers a good $5000 borrowing limit, you now have $1000 value of obligations to an effective $5000 limitation, and also you jump up so you’re able to an excellent 20% debt-to-credit ratio. Not greatest.

Credit history is yet another important factor and 15% of the credit rating depends on along your credit history, and closure notes usually reduce steadily the average timeframe you’ve got borrowing Even if the notes haven’t any perks gurus or high-interest rates, utilize them one or more times twice yearly to eliminate their reputation switching to inactive. Which get is just as quick because the to purchase lunch however you will reap the credit perks.

Improve borrowing from the bank restrictions

So it idea goes hands-in-hand into past that. You could potentially get in touch with your creditors every six months and you can demand a credit limit increase. If you have a solid reputation of making your repayments on the big date, so it must not be a problem. Shortly after acknowledged having a high borrowing limit, it is possible to instantly reduce your personal debt-to-borrowing proportion and you will credit application mention several wild birds, you to brick!

The trail so you’re able to a better Credit rating

These types of four effortless resources are created to make it easier to quickly improve your credit rating. From the holding onto men and women old cards, to avoid later costs, and improving your personal debt-to-borrowing from the bank proportion, you’ll end up on your way to presenting a credit rating that makes you feel satisfied and offer loan providers the new count on to approve your loan.