Is actually Virtual assistant Funds Assumable? | An invisible Benefit to Their Va Financing

Inside a world where really mortgages are not assumable, you could potentially question was Va money assumable? The new small response is yes, he’s. One to places your, given that merchant with a beneficial Va financing, for the yet another reputation. Supplying the consumer the ability to assume your financial and buy your home in the an environment from ascending interest levels is actually an excellent extreme work with. Although not, whenever home financing can get a little challenging, particularly because you wish to be able to include your Virtual assistant financing benefit.

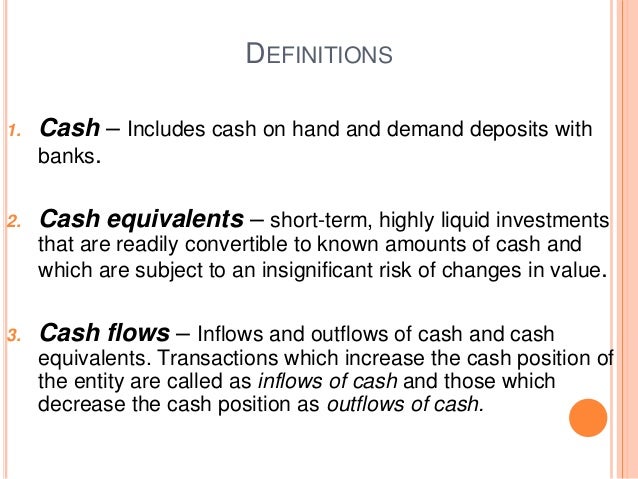

What’s a keen Assumable Mortgage?

How much does it mean, after that, to-do an excellent Va loan expectation? It means you can sign your home loan and family over so you can other people, and they’ll become new manager of each other house and you may mortgage. They shall be accountable for paying the monthly mortgage repayments and all other issues that are worried with purchasing a house, and you can move on to your upcoming home. The customer which assumes on the loan is also forget an abundance of this new documentation one to complements a timeless business, nevertheless actual work for is capable guess a mortgage with a lesser interest than simply happens to be available.

- Assumable mortgage loans are uncommon. Most antique mortgage loans and lenders commonly assumable. Va loans and you will FHA finance are among the conditions in order to you to code as they are assumable.

- A lot of the danger from inside the an assumable home loan situation is by using owner. You ought to make up many of these dangers for individuals who was property seller as they are provided allowing a buyer assume the mortgage.

- Dangers for the borrowing when your consumer misses costs

- Dangers towards the Virtual assistant entitlement (much more about one below)

Who will Imagine The loan?

New consumer does not have to feel a veteran otherwise qualified to receive experts positive points to guess your own home loan. There are particular advantages if they are, however, you can now assume your Virtual assistant financing.

That’s where we want to step-back and take comparison out-of what the Virtual assistant financing really is. The Virtual Texas installment loans assistant financial program indeed secures and guarantees your loan when you are a qualified seasoned, but the currency originates from a private home loan company who together with need approve the mortgage. That personal bank, who is probably your current mortgage lender, should agree the belief of your own present mortgage according to the financing records and you will DTI ratio of your customer.

- A credit history out of 620 or most readily useful

- A debt-to-earnings proportion below 41%

- Adequate continual earnings on their own and their household members

The consumer also needs to concur that our home whose home loan they tend to assume was its no. 1 household. The non-public bank may need other files and you will proofs out of a job and money, but in terms of of course your financial, the ball is actually inside their judge. Up to now, it is worthy of a note one to Household to own Heroes may help connect you with an exclusive mortgage pro who’s familiar with all new ins and outs of the fresh new Virtual assistant mortgage loans (whether you’re a buyer otherwise a vendor).

If this is an in-kind expectation of one’s home loan ranging from an effective Virtual assistant accepted merchant and you can an effective Virtual assistant recognized buyer, a number of the Va loan pros will import. Specifically, an eligible Va client can be replacement the entitlement to you towards the the borrowed funds.

Entitlement and why You will want to Protect it

We probably must not go any more rather than describing the newest Virtual assistant entitlement. In your Certification of Eligibility, issued by the You.S. Agencies off Pros Circumstances, there’s an eye on how much youre permitted because an experienced veteran or effective obligations military user. Its from inside the a money shape, also it reveals how big is the borrowed funds this new Va often guarantee to you. The top of the size is $647,000, so if you enjoys the full entitlement, you might use up to you to number in addition to Va have a tendency to insure the borrowed funds (think about, the cash however has to be passed by individual bank).