While making a great Fidelity 401(k) withdrawal in advance of decades 60 must be a last resorts

Not only will you pay tax charges in some cases, but you happen to be along with robbing on your own of immense great things about compound interest. For this reason it’s very important to take care of an emergency funds to fund any small-title currency means rather than costing your self most by making good 401(k) very early detachment.

not, lifetime has actually a way of throwing you curveballs that may leave your which have couple to not one choices. For many who really are inside a monetary emergency, you are able to a withdrawal for the basically the same way due to the fact a consistent detachment. The shape is filled out in different ways, you could notice it to the Fidelity’s site and request a beneficial unmarried lump https://clickcashadvance.com/loans/loans-for-self-employed/ sum otherwise multiple scheduled repayments.

For many who act rashly, in the event, and commence and come up with distributions before the period of 59 step 1/2, you essentially busted your pact for the regulators to pay you to money on advancing years. As a result, it is possible to shell out income tax punishment that can reduce the nest egg earlier gets to your. Good 401(k) early detachment form an income tax punishment regarding 10% in your withdrawal, that’s in addition typical income tax analyzed on the the bucks. When you’re currently earning a frequent income, your own early detachment can potentially push you into a top tax bracket whilst still being have one to extra penalty, it is therefore an extremely costly detachment.

401(k) Adversity Detachment

You can find, yet not, a number of different issues for which you normally avoid that more taxation punishment. The brand new Irs allows for a 401(k) difficulty detachment in some situations instance a healthcare crisis or perhaps to pay money for funeral expenses, incase your be considered, possible nonetheless shell out normal income taxes for the money but zero even more penalties.

There are many most other unique exclusions that will enable your to make an earlier detachment without having to pay more taxation in this specific limitations, also purchasing educational costs or purchasing your very first family. Consult with a beneficial Fidelity representative before generally making a withdrawal in order to be sure to are not using one a lot of charges.

If you plan and come up with a trouble detachment, you should be prepared to promote research so you’re able to Fidelity. Lower than was a record of the records you might need:

- Fidelity withdrawal versions: You will need to offer some factual statements about your account.

- Bills of your own can cost you creating your adversity: A charge off a funeral service household otherwise builder bringing a necessary home fix could be adequate proof debt hardship.

Later years Considered Implications

When you find yourself up against a financial hardship one to forces that capture funds from your own 401(k) prematurely, you will need to read this can enjoys a negative impact on your own enough time-term old age arrangements. When you eliminate loans out of your membership, you are reducing quick its potential to expand more your work. Run the fresh new amounts to see how which struck for the financing levels might impression retirement nest egg. Oftentimes, pulling-out the funds very early is a big problem on your senior years believe.

Choice Financial support Alternatives

- 401(k) loan: An excellent 401(k) mortgage as a result of Fidelity makes you obtain some funds out of your 401(k). As a whole, you’re going to have to pay off the borrowed funds in this five years.

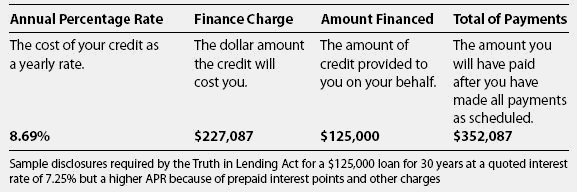

- House collateral financing: A house security loan enables you to utilize the significance in your home guarantee. Even in the event you have an additional mortgage repayment, you could potentially log off pension finance untouched.

- Consumer loan: A keen unsecured consumer loan makes it possible to get the loans you you desire in the place of an excellent 401(k) detachment or making use of your property guarantee. That it adds a repayment into the monthly bills. Nonetheless it could help cover a big initial cost.